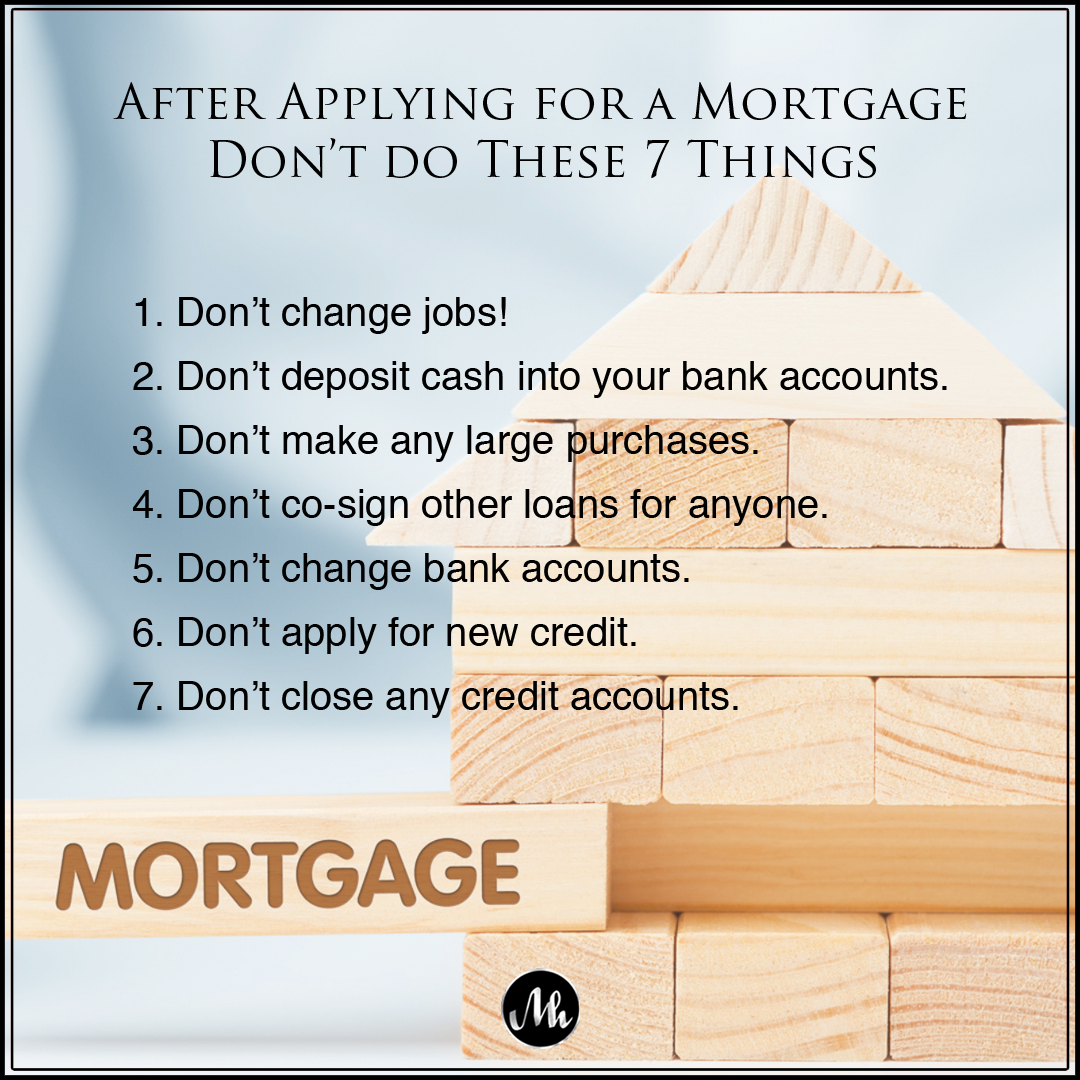

Here are a few mortgage don’ts to make the application process less stressful; especially if it’s your first time. We have also included a graphic you may download as a reminder while you go through the process.

Don’t change jobs:

When applying for a mortgage, your income and your length of employment both play a part in qualification. Changing to a job with a lower salary could prevent you from qualifying, so could changing fields. Also, a job change will cause your lender to have to verify your income and employment again, which could cause delays in approval. Potential delays that might result in losing the home you want. As mortgage don’ts go – this is a big one.Don’t deposit cash into your bank accounts:

Undocumented cash suddenly appearing makes banks nervous. It could be seen as personal loans that need to be repaid – increasing your debt. Discuss any large cash deposits with your lender before you put them in your account.Don’t make any large purchases:

Large purchases could deplete your savings, or cause an increase in your debt ratio. Both of these things risk delaying or preventing your loan approval. Talk to your lender before you make any new purchases over $500.Don’t co-sign loans:

You are agreeing to be responsible for someone else’s debt if it isn’t paid. This kind of financial obligation can have a negative impact on your ability to acquire a mortgage. It can also negatively affect your credit.Don’t change bank accounts:

Changing bank accounts can hold up the approval process. You may find yourself needing to explain why, and re-submitting documents unnecessarily. Check with your lender before you make financial changes.Don’t apply for new credit:

ANY new credit. New credit can negatively impact your credit score and your debt ratio. Both things have the potential to prevent mortgage approval. Be patient, wait until you are approved and your loan closes before you get new credit.Don’t close any credit accounts:

You may think it seems like a good idea to close credit accounts that you haven’t used in ages – don’t. Your credit score is a calculation of when you pay, how much is open vs. used, and the age of your credit history. Closing accounts can adversely affect your score, and thereby your approval odds.

Give your lender a call If you are ever in doubt as to what you should or shouldn’t do once you have applied for a mortgage. They have the knowledge and experience to help you navigate the process, let them.

Want more helpful tips? Click here. Would you like information regarding buying or selling a home? Get in touch – we’re here to help you reach your real estate goals.