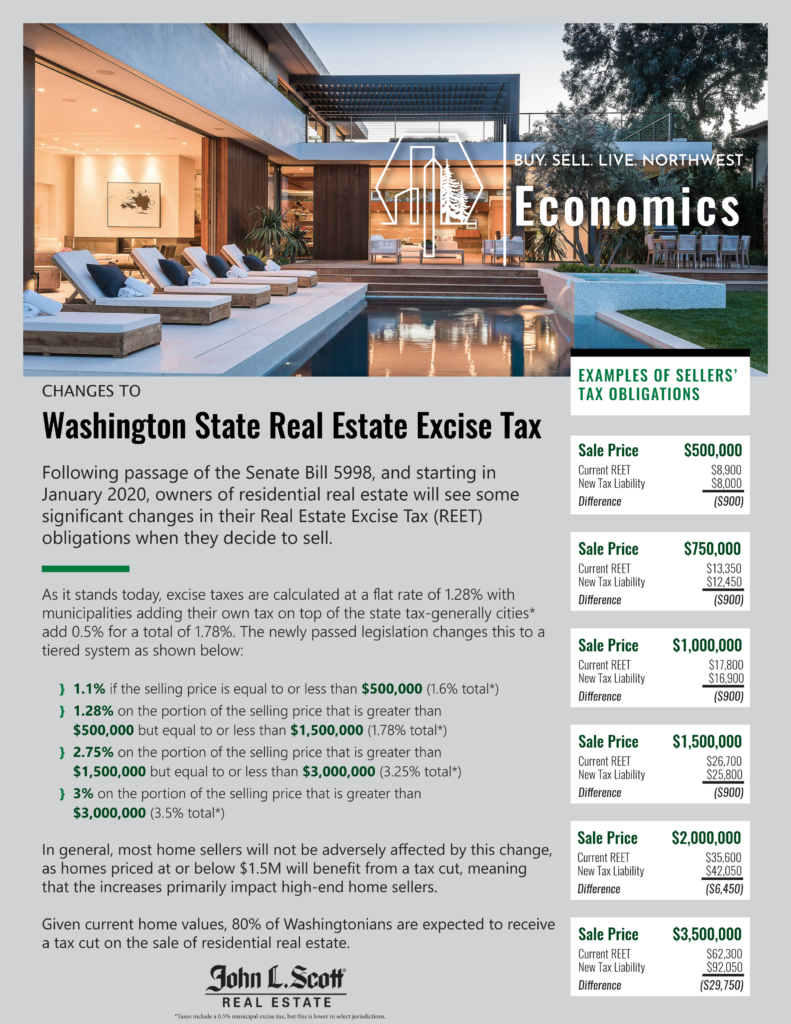

A new decade is here and with it comes significant change to Washington State’s Real Estate Excise Tax (REET). When you sell your property you pay Excise tax based on a percentage of the value. Washington State Senate Bill 5998 was signed into law changing our local real estate excise tax from a flat rate to a tiered system. This change gives owners a tax cut on the first $500,000 of value and keeps the current rate on the next $1 million. However, it also includes an increase after $1.5 million in value.

Excise Tax Details

Each jurisdiction has been actively managing the local portion of excise tax. Surprisingly, the state rate hasn’t changed their portion since July of 1989. For more details on Real Estate Excise Tax, visit the Washington State Department of Revenue. In addition to changes in the tax rate, the distribution of the tax has also changed. Until now about 92% of all excise tax collected has gone to the General Fund. As of January 1, 2020 only 79% will go to the General Fund. New distributions will include:

- 1.7% to the Public Works Assistance Account

- 1.4% to the City-County Assistance Account

- The balance (just over 17%) to the Education Legacy Trust Account.

Additional changes to the distribution of funds will take place on July 1, 2023.

Tax Affects

The really good news is that excise taxes have been reduced for most sellers. But, if you own a luxury home that sells for more than $1.5 million you will be paying more. And, if you are fortunate enough to have a home that sells for over $3.5 million, you could be looking at an increase as much as 30%.

Wondering how the changes might impact you when you decide to sell? Take a look at our infographic below to get a general idea of the affects this new tax update will have.

For a clearer picture of this and other factors related to the sale of your home, feel free to contact us to get your market valuation and net proceeds estimate.